Posts Tagged ‘ira’

Tutorial of Tax-Sheltered Savings Plans for 2014

Some of the most powerful planning tools are the tax-sheltered savings plans available to almost every business. But these tools won’t help you if you don’t know how they work. We’ve published an executive summary for you below. If you’d like to pay less tax and increase your retirement fund, review the chart below. We…

Read MoreGoing for the max! Qualified plan limits for 2014

When a financial move helps you, it’s best to go for the max. Here are the new limits for your 401(k), IRA, Roth-IRA, and several other types of tax-qualified plans for this year. Need some help in deciding on the type of plan? Remember that we’re just a click away when you need help. [popup…

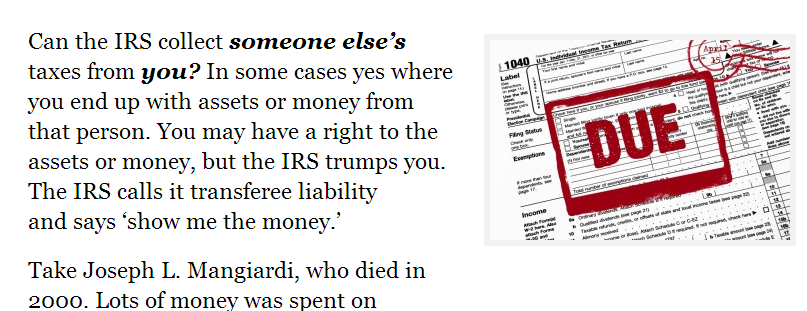

Read MoreCan IRS make you pay someone else’s tax 10 years later?

Just ask Maureen Mangiardi. Ten years after her father passed away the IRS came to the door asking for her IRA.

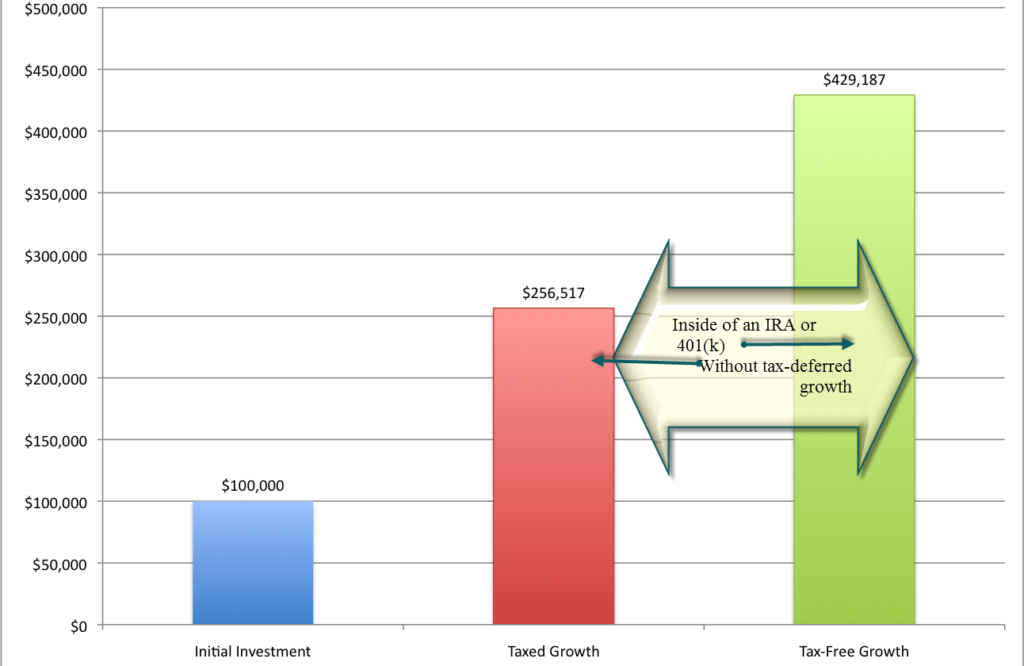

Read MoreWhy we recommend tax-deferred growth!

This is the reason we recommend tax-deferred growth for your Investments.

Read MoreTime running out for a do-over on your IRA distribution!

As our golfer friends say, time is running out for a mulligan on any IRA distributions that were required by 12/31/12. The fiscal cliff law signed by the President on January 2 has a retroactive provision that could help you out of a jam if you forgot to take a RMD (required minimum distribution) from…

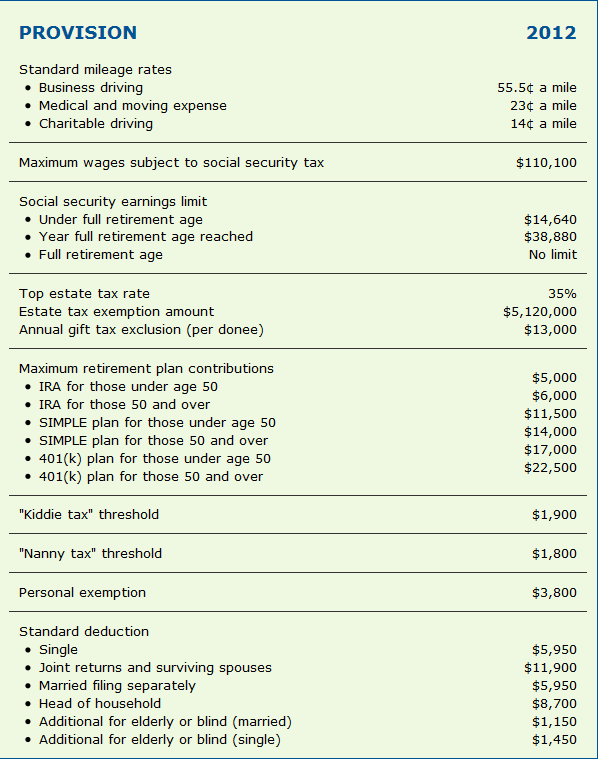

Read MoreHow to keep score in 2012

Congress has once again adjusted the dollar amount of allowabe mileage,social security limits,estate rates, and a host of other deductions. Here’s a handy scorecard for 2012.

Read More