Posts Tagged ‘irs’

IRS, Star Trek, and Gilligan’s Island

See the Star Trek and Gilligan’s Island parody videos that cost $70,000 of the taxpayers’ money

Read MoreIRS releases revised E-File date

You may remember our post a few weeks ago where the IRS predicted that the fiscal cliff may cause filing delays until the end of March for complex returns. Due to a semi-solution by Congress, we now have IRS confirmation that January 30 is approved as the first day for E-Filing. Advanced returns will still be…

Read MoreIRS offers a clean slate for the past. . .

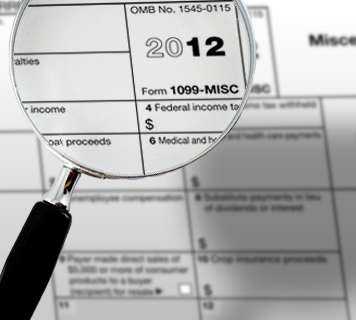

Last year’s tax returns included two new questions. They both pertain to 1099 payments and, if unanswered, prevented you from E-Filing. If you’ve worried about 1099 vs employee problems with the IRS, there’s now a chance to wipe the slate of the past clean and start over. IRS is willing to forgo the audit of…

Read MoreA Cliff Notes Summary of the Fiscal Cliff Law

We’ve reviewed the 157 page sorry excuse for a err I mean problem-solving bill Congress passed last night. Sorry that it is (raises taxes, but no spending cuts to speak of), we at least have an idea of what’s coming in 2013. Here are the main (but not all) areas that will effect your return…

Read MoreIRS begins a “Hiring Frenzy”

See the second video if you still believe it’s possible to administer the health care debacle. Here’s just how easy it is to calculate.

Read MoreIndependent Contractor vs. Employee – IRS throws a bargaining chip into the mix

The IRS has launched a new program that may help employers to resolve past worker classification issues (Independent Contractor vs. Employee) at a relatively low tax cost by voluntarily reclassifying their workers. As regular readers know, IRS’ attitude on this issue has been less than helpful in the past. Personally, I do not know of…

Read MoreIntuit solves the wrong problem with a new Quickbooks option

For clients using Quickbooks, here’s a useful tip from one of our most trusted sources for software training. The instructors at K2 Enterprises will walk you through the process of limiting your Quickbooks data file to the current year. This will make QB run faster and more efficiently, but this does not solve the IRS…

Read MoreIRS targets Quickbooks and Peachtree users and makes outrageous demands!

We’ve known for some time of the IRS’ stated intent to educate at least one member of every audit team with advanced knowledge of Quickbooks and Peachtree Accounting. Given that these two programs have over 80% of the small business software market, one could understand this goal. The unsettling news is that IRS intends to…

Read MoreCustomer no-service from IRS gets even worse!

As if things weren’t bad enough, now the less-than-sterling level of IRS service just got worse. It’s not just my opinion, check out this eye-opening article from “Forbes.” IRS Gone Bad: Are Things About to Get Even Worse? The details aren’t all that important. Basically, I called the IRS to discuss a client’s tax…

Read More40 million dollars for a few less IRS agents? What a deal!

The problem is that it’s a deal for the government employees and not the taxpayers. An IRS early buyout program of up to $25,000 per individual will be offered to 5,400 employees with plans to accept about 1,600 individuals. Some may debate that fewer agents are worth the price tag, but I wonder if…

Read More