Posts Tagged ‘Medicare’

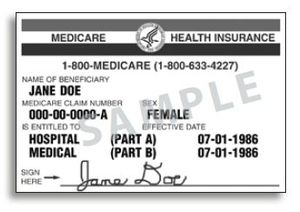

HSA for Seniors on Medicare?

From our friend and elder-law attorney Ira Leff (used with permission). 32 million Americans currently maintain Health Spending Accounts (HSAs). These accounts provide three types of tax benefits: contributions are tax-deductible, earnings are tax-free, and withdrawals are not subject to taxation if they are used to pay qualified medical expenses. As of the end of…

Read MoreAn Extra 100 days of Medicare Coverage

Most of our clients who are elder-care providers are aware of the 100 days of skilled care (Nursing Home Coverage) that Medicare will provide. Due to the COVID crises, an extension of this timeline is available. Elder-Law Attorney Ira Leff describes this in detail on his website. The summary below is reprinted with permission from…

Read MoreHow to navigate the Medicare maze

Common pitfalls in applying for Medicare.

Read MoreSticker shock awaits many clients on their 2013 tax return

Many folks will get a severe case of sticker shock in 2013. Here’s why.

Read MoreHow to avoid payroll taxes

Wouldn’t it be helpful with your company’s cash flow if you could just not remit the social security and medicare withholding taxes? We don’t recommend this as a strategy but, according to the US Inspector General, it’s working pretty well for some Federal agencies. These Federal agencies owe over 14 million of back payroll taxes…

Read MoreThe Anti-Investment tax of 2013! We explain how and when it applies.

CPA gives 3 minute summary of the new Medicare tax

Read MoreA tutorial for business owners on the new Medicare tax

An individual is liable for Additional Medicare Tax if the individual’s wages, other compensation, or self-employment income

(together with that of his or her spouse if filing a joint return) exceed the threshold amount for the individual’s filing status:

Hidden provisions in the Extended Payroll Tax Cut

Payroll Tax Cut Extended for All of 2012 On February 22, 2012, the Temporary Payroll Tax Cut Continuation Act of 2011 was permanently extended for all of 2012. This extends the two percentage point payroll tax cut for employees, continuing the reduction of their social security tax withholding rate from 6.2 percent to 4.2…

Read More