Posts Tagged ‘retirement plans’

The biggest no-brainer for 2019 tax planning

We’re in the new year now. and it’s never too early to start saving taxes. The reason we call this the “no-brainer” of tax planning is simple. Amounts that are timely contributed to your Simple-IRA, 401(k), SEP-IRA, etc. are fully deductible, These amounts enjoy tax-deferred growth (the 8th wonder of the financial…

Read MoreNew 2018 limits on deductions for retirement

Plan now for next year’s larger amounts.

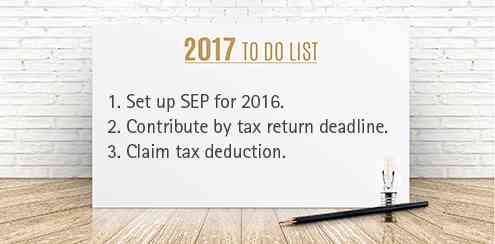

Read MoreRetro-active tax planning after the year ends

SEPs are sometimes regarded as the no-brainer for high-income small-business owners who don’t currently have tax-advantaged retirement plans.

Read MoreBreaking tax news for 2013!

IRS just announced the new (and higher) limits on 401(k) plans etc. Here’s a summary for use in 2013 tax planning. The inflation-adjustments for 2013 include: Gift Tax Exemption: $14,000 (up $1,000 from 2012) Contribution Limit for 401(k)/403(b)/457 Plans: $17,500 (up $500 from 2012) Catch-Up Contribution Limit (Age 50+) for 401(k)/403(b)/457 Plans: $5,500 (same as 2012)…

Read More