Posts Tagged ‘RMD’

RMDs made PDQ

This subject reminds of a famous line from the movie Jurassic Park. “Your scientists were so preoccupied with whether or not they could, they didn’t stop to think if they should.” So even though you could access your IRA account in a tax-advantaged way, you should be careful about raiding your retirement funds except for…

Read MoreThe SECURE ACT – New Rules for Retirees

New Law Extends Key Tax Breaks into 2020 — aka How Congress tries to upset your year-end planning Just when it seemed like Congress was too distracted by impeachment proceedings and national security to worry about taxes, they throw curveballs into our year-end tax planning. The Extenders and Secure (Retirement) Act are just a…

Read MoreThe other tax date in April

The other tax date in April – this one can cost you 50%

Read MoreA tax break for Seniors

Sometimes Congress actually gets something right! This happens so rarely that I wanted to write a special blog post on it. Clients who have followed our advice over the years tend to retire with no mortgage debt and few out-of-pocket medical expenses. This leaves their charitable contributions as the main source of itemized deductions to…

Read MoreDid you think the 50% tax rate was gone?

The other tax date in April – this one can cost you 50!

Read MoreWho gets your Roth-IRA money? (Part IV of Keeping it All in the Family)

Who gets the money from a ROTH-IRA?

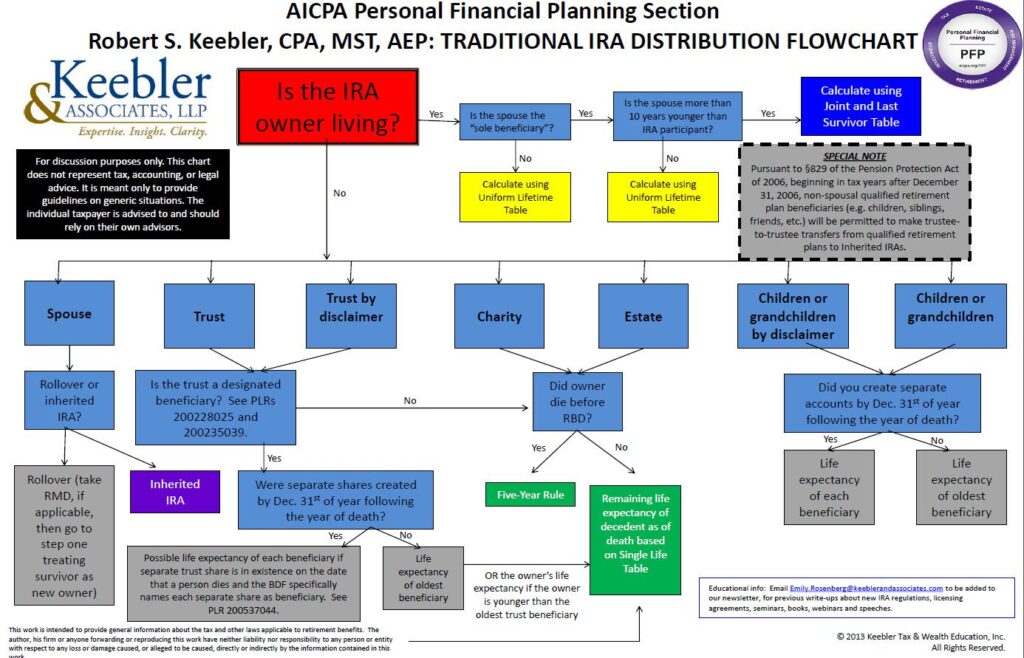

Read MoreWho gets your IRA? It’s not always a simple decision!

When does money have to be paid from an IRA? The answers may surprise you.

Read MoreCan IRS make you pay someone else’s tax 10 years later?

Just ask Maureen Mangiardi. Ten years after her father passed away the IRS came to the door asking for her IRA.

Read More