Posts Tagged ‘Roth’

Summary of IRA deduction rules

Quick summary of IRA rules The maximum annual contribution limit is $6,000 in 2021 and 2022 ($7,000 if age 50 or older). Contributions may be tax-deductible in the year they are made. Investments within the account grow tax-deferred. Withdrawals in retirement are taxed as ordinary income. The IRS requires individuals to begin taking money out of…

Read MoreMeet the entire IRA family

The members of the IRA family are very different from each other.

Read MoreA Planning Tool for 2016 and beyond

Confused about the tax tools for retirement planning? Here’s some help.

Read MoreYear-End Planning Information for 2014 & 1015

Here’s a complete list of qualified plan limitations, You may want to bookmark this page in your browser for use now and next year.

Read MoreWho gets your Roth-IRA money? (Part IV of Keeping it All in the Family)

Who gets the money from a ROTH-IRA?

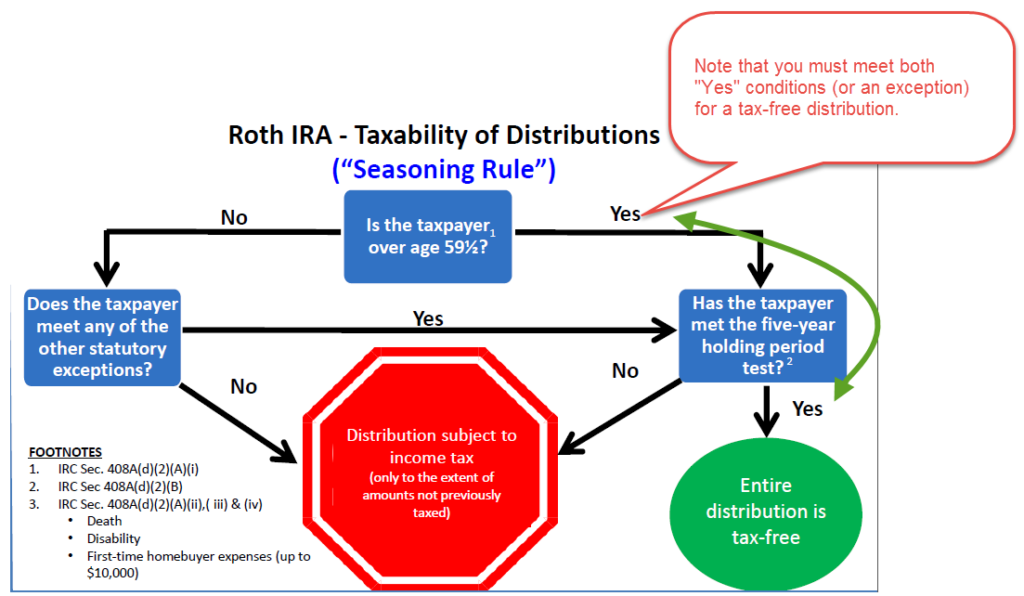

Read MoreRoth-IRAs demand equal time! (Keeping it all in the family Part III)

Here are the answers to the two most often asked questions we get on the subject of Roth accounts.

Read MoreGoing for the max! Qualified plan limits for 2014

When a financial move helps you, it’s best to go for the max. Here are the new limits for your 401(k), IRA, Roth-IRA, and several other types of tax-qualified plans for this year. Need some help in deciding on the type of plan? Remember that we’re just a click away when you need help. [popup…

Read MorePlanning or Just Playing Scrabble?

Retirement Planning – it’s more than a game of scrabble? Some of the 2013 retirement plan limits have changed. Good planning involves trying to max out these amounts every year. Stop playing a game of scrabble with your retirement and hoping for some lucky tiles to come your way. We can help you determine how much…

Read More