Posts Tagged ‘Withholding tax’

Where did that withholding on your check come from?

It’s too bad that our grandparents didn’t realize what a Pandora’s Box they were about to open!

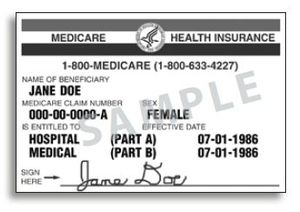

Read MoreA tutorial for business owners on the new Medicare tax

An individual is liable for Additional Medicare Tax if the individual’s wages, other compensation, or self-employment income

(together with that of his or her spouse if filing a joint return) exceed the threshold amount for the individual’s filing status:

Hidden provisions in the Extended Payroll Tax Cut

Payroll Tax Cut Extended for All of 2012 On February 22, 2012, the Temporary Payroll Tax Cut Continuation Act of 2011 was permanently extended for all of 2012. This extends the two percentage point payroll tax cut for employees, continuing the reduction of their social security tax withholding rate from 6.2 percent to 4.2…

Read More