How to save taxes? Let’s count the ways.

Seniors will love the new tax bill!

If you are 65 years of age or older, several provisions in the One Big Beautiful Bill Act (“Big Beautiful Bill”) would be especially relevant: In summary, the most significant changes for someone age 65 or older are the new temporary $6,000 senior deduction, increased standard deduction amounts, and higher filing thresholds

Read MoreOut with the old – in with the new 2023 mileage rates

It’s easy to forget about the business use of your personal car. Here’s how to calculate this deduction for all your business miles.

Read MoreAre there exceptions to the 10% early withdraw Penalty?

Actually there are quite a few. Here’s a partial list.

Read MoreWhy you should start a 529 Plan for your 2 year-old child

Start the 15-year clock! Open a 529 plan for each child today. It doesn’t take thousands of dollars or in some cases even hundreds of dollars-maybe as little as $100 to open this savings account. By opening it now the parent can start the 15-year savings clock so that all earnings in the account are…

Read MoreMore Security from the Secure Act 2.0

At What Age Does the Government Require the RMD? The chart below gives you the age when you have to start taking RMDs: Your Birth Year Your Mandatory RMD Age 1950 or earlier 72 (70.5 for those who turned 70.5 before 2020) 1951-1959 73 1960 or later 75 When Do I Have to Take My…

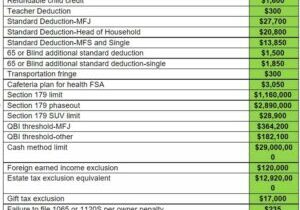

Read MoreInflation adjustments to tax items

With inflation at a 40-year high, inflation-adjusted tax amounts have kicked into place. Here are the increased amounts for 2022 and 2023.

Read MoreIRS grants penalty relief!

This is a rare gift from the imperial IRS. Check the article below for details.

Read MoreMMDA- Making meals deductible again

Have you missed partying and having business meals with your prospects, customers, and employees? Well, get ready to start again. Soon, COVID-19 will be behind us, we can get back to normal. To help you get ready, check the table below for what you can do in 2021 and 2022 as the law stands now:…

Read MoreHow to save taxes? Let’s count the ways.

“To Sell or Not to Sell -that is the question.” – William Shakespeare [edited]

Although we don’t give investment advice, we thought a simple math formula that helps you maximize your stock gains might be useful.

IRS allows a “mulligan” on Obamacare penalties

Occasionally IRS will surprise you and do something that actually makes common sense for our small business clients.

How to E-Sign your individual tax return

How to E-Sign your individual tax return

Myths about Taxable Income

My Social Security benefits aren’t taxable. Depending on the amount of other income that a taxpayer has to report, their…

Repair Expenses

New IRS regs add time and expense to every business’ depreciation calculation.

What happens if the Net Neutrality law is approved.

Fairness and neutrality sure sound like good ideas, but when they’re administrated by Washington – here’s what’s likely to happen:

Minimum Wage Changes for 2014

Here’s an update on the changes in the Minimum Wage amounts for the coming year.

Why tax year 2014 requires more work

In March, 2010. President Obama signed the Affordable Care Act. One provision of the Act required that in 2014 all…

Out with the old – in with the new mileage rates

It’s easy to forget about the business use of your personal car. Here’s how to calculate this deduction for all your business miles.

Helpful Tools for Clients

For our first-time guests and new clients:

The first thing that you should look for in your Financial Advocate is the right attitude.

At SCA we don't believe in the "one size fits all" method of thinking. We post recent articles that may serve to help you save or make more money.