How to save taxes? Let’s count the ways.

Seniors will love the new tax bill!

If you are 65 years of age or older, several provisions in the One Big Beautiful Bill Act (“Big Beautiful Bill”) would be especially relevant: In summary, the most significant changes for someone age 65 or older are the new temporary $6,000 senior deduction, increased standard deduction amounts, and higher filing thresholds

Out with the old – in with the new 2023 mileage rates

It’s easy to forget about the business use of your personal car. Here’s how to calculate this deduction for all your business miles.

Are there exceptions to the 10% early withdraw Penalty?

Actually there are quite a few. Here’s a partial list.

Why you should start a 529 Plan for your 2 year-old child

Start the 15-year clock! Open a 529 plan for each child today. It doesn’t take thousands of dollars or in some cases even hundreds of dollars-maybe as little as $100 to open this savings account. By opening it now the parent can start the 15-year savings clock so that all earnings in the account are…

More Security from the Secure Act 2.0

At What Age Does the Government Require the RMD? The chart below gives you the age when you have to start taking RMDs: Your Birth Year Your Mandatory RMD Age 1950 or earlier 72 (70.5 for those who turned 70.5 before 2020) 1951-1959 73 1960 or later 75 When Do I Have to Take My…

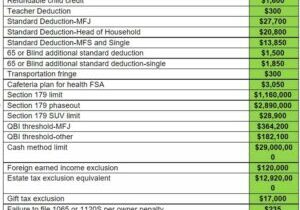

Inflation adjustments to tax items

With inflation at a 40-year high, inflation-adjusted tax amounts have kicked into place. Here are the increased amounts for 2022 and 2023.

IRS grants penalty relief!

This is a rare gift from the imperial IRS. Check the article below for details.

MMDA- Making meals deductible again

Have you missed partying and having business meals with your prospects, customers, and employees? Well, get ready to start again. Soon, COVID-19 will be behind us, we can get back to normal. To help you get ready, check the table below for what you can do in 2021 and 2022 as the law stands now:…

How to save taxes? Let’s count the ways.

5 Years to write off a $100 thumb drive? We’re not kidding on this one.

Now is the time to “repair” the deduction for repairs! You’ll have a hard time believing this one, but here…

For advanced clients only

For our clients who have advanced knowledge of the dangers starting January 1 (to join this group, Click Here and…

The fiscal cliff in graphic form

Hollywood’s Friday the 13th and Freddy Kruger can’t begin to compare to how scary this picture promises to be. Coming…

Specific info on the Fiscal Cliff

Detailed information of the peaks and valleys of the Fiscal Cliff Our last newsletter (see this link) contained general…

The Dark Knight vs. H&R Block

Bruce Wayne (aka Batman) may be out to get Block (H & R), not the villainous Bain. Seems like H&R did a…

Is there a way to deduct my political donation?

Is there a way to deduct a political donation? The answer may surprise you. More than most…

Breaking tax news for 2013!

IRS just announced the new (and higher) limits on 401(k) plans etc. Here’s a summary for use in 2013 tax planning. …

A Tale of Two Tax Plans

With apologies to Charles Dickens, here’s an easy to understand graphic of how the upcoming tax plans measure up. Source: www.backtaxeshelp.com

Helpful Tools for Clients

For our first-time guests and new clients:

The first thing that you should look for in your Financial Advocate is the right attitude.

At SCA we don't believe in the "one size fits all" method of thinking. We post recent articles that may serve to help you save or make more money.