How to save taxes? Let’s count the ways.

Seniors will love the new tax bill!

If you are 65 years of age or older, several provisions in the One Big Beautiful Bill Act (“Big Beautiful Bill”) would be especially relevant: In summary, the most significant changes for someone age 65 or older are the new temporary $6,000 senior deduction, increased standard deduction amounts, and higher filing thresholds

Out with the old – in with the new 2023 mileage rates

It’s easy to forget about the business use of your personal car. Here’s how to calculate this deduction for all your business miles.

Are there exceptions to the 10% early withdraw Penalty?

Actually there are quite a few. Here’s a partial list.

Why you should start a 529 Plan for your 2 year-old child

Start the 15-year clock! Open a 529 plan for each child today. It doesn’t take thousands of dollars or in some cases even hundreds of dollars-maybe as little as $100 to open this savings account. By opening it now the parent can start the 15-year savings clock so that all earnings in the account are…

More Security from the Secure Act 2.0

At What Age Does the Government Require the RMD? The chart below gives you the age when you have to start taking RMDs: Your Birth Year Your Mandatory RMD Age 1950 or earlier 72 (70.5 for those who turned 70.5 before 2020) 1951-1959 73 1960 or later 75 When Do I Have to Take My…

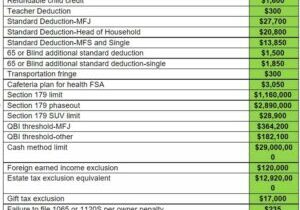

Inflation adjustments to tax items

With inflation at a 40-year high, inflation-adjusted tax amounts have kicked into place. Here are the increased amounts for 2022 and 2023.

IRS grants penalty relief!

This is a rare gift from the imperial IRS. Check the article below for details.

MMDA- Making meals deductible again

Have you missed partying and having business meals with your prospects, customers, and employees? Well, get ready to start again. Soon, COVID-19 will be behind us, we can get back to normal. To help you get ready, check the table below for what you can do in 2021 and 2022 as the law stands now:…

How to save taxes? Let’s count the ways.

Simple in Sixty – Excel Tables

Learn some of the benefits of Excel tables in sixty seconds!

The Electoral College – should we eliminate it?

Doe the EC still serve a useful purpose? The answer is surprising!

An Extra 100 days of Medicare Coverage

Most of our clients who are elder-care providers are aware of the 100 days of skilled care (Nursing Home Coverage)…

Should you move to a state without income tax?

If you’re considering moving to a different state, taxes in the new state may be the deciding factor—especially if you…

Facts about IRS and Forfeiture of Assets

When you get two tax attorneys discussing how IRS can take your assets before you are even accused of a…

Is your business safe from Covid lawsuits?

Our friends at the law firm of Berman, Fink Van Horn PC just published an excellent article on protecting your…

Rioting damage to your business

I recently spoke to a client in North Atlanta whose business storefront suffered damage from the riots in…

Do you wish that people gave you more credit?

Work Opportunity Tax Credit extended through 2020 If you’re a business owner, be aware that a recent tax law extended…

The most oft-asked question about stimulus checks

Q: What if you had extra one-time income (an IRA withdraw for example) and exceeded the income limit to receive…

Helpful Tools for Clients

For our first-time guests and new clients:

The first thing that you should look for in your Financial Advocate is the right attitude.

At SCA we don't believe in the "one size fits all" method of thinking. We post recent articles that may serve to help you save or make more money.