How to save taxes? Let’s count the ways.

Seniors will love the new tax bill!

If you are 65 years of age or older, several provisions in the One Big Beautiful Bill Act (“Big Beautiful Bill”) would be especially relevant: In summary, the most significant changes for someone age 65 or older are the new temporary $6,000 senior deduction, increased standard deduction amounts, and higher filing thresholds

Out with the old – in with the new 2023 mileage rates

It’s easy to forget about the business use of your personal car. Here’s how to calculate this deduction for all your business miles.

Are there exceptions to the 10% early withdraw Penalty?

Actually there are quite a few. Here’s a partial list.

Why you should start a 529 Plan for your 2 year-old child

Start the 15-year clock! Open a 529 plan for each child today. It doesn’t take thousands of dollars or in some cases even hundreds of dollars-maybe as little as $100 to open this savings account. By opening it now the parent can start the 15-year savings clock so that all earnings in the account are…

More Security from the Secure Act 2.0

At What Age Does the Government Require the RMD? The chart below gives you the age when you have to start taking RMDs: Your Birth Year Your Mandatory RMD Age 1950 or earlier 72 (70.5 for those who turned 70.5 before 2020) 1951-1959 73 1960 or later 75 When Do I Have to Take My…

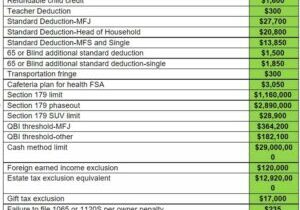

Inflation adjustments to tax items

With inflation at a 40-year high, inflation-adjusted tax amounts have kicked into place. Here are the increased amounts for 2022 and 2023.

IRS grants penalty relief!

This is a rare gift from the imperial IRS. Check the article below for details.

MMDA- Making meals deductible again

Have you missed partying and having business meals with your prospects, customers, and employees? Well, get ready to start again. Soon, COVID-19 will be behind us, we can get back to normal. To help you get ready, check the table below for what you can do in 2021 and 2022 as the law stands now:…

How to save taxes? Let’s count the ways.

If the census people were honest . . .

This is what they would say . . .

Why budgets have no value

You heard us right-they have no value. Jack Welch the brilliant CEO of General Electric agrees with me (don’t confuse him with the current clown at the head of GE). Welch did away with all the wasted weeks of the budget process and focused on creating projections instead. He then held the departments accounting to the projection of income and expense that they participated in creating.

Turn off the TV and watch some moving images that will save you time and dollars

It’s not as entertaining as Hawaii Five-0, but our suggestions just might add a 0 (zero) to your cash flow…

Will Smith becomes a capitalist

The text of this conversation is printed below. Will Smith: I have no issue with paying taxes and whatever needs…

If we did Financial Statements like the White House and Congress . . .

We would simply overstate your net income by 384%! Not surprisingly, the White House and Congress speak of…

How to use Facebook for Business

Most of us spend some amount of time on Facebook. Did you ever wish that you could better use your…

How long does a business need to keep its records?

Does your office tend to look like our Fayette county landfill with tons of old paperwork? Although there is no…

American Exceptionalism

Some politicians in Washington may say American Exceptionalism doesn’t exist, but don’t you believe it! Here’s some proof. The photo on…

The real effect of a federal “Stimulus” tax law

We took our SCA hidden camera inside the corporate boardrooms of America and, more often than not, found this reaction…

Helpful Tools for Clients

For our first-time guests and new clients:

The first thing that you should look for in your Financial Advocate is the right attitude.

At SCA we don't believe in the "one size fits all" method of thinking. We post recent articles that may serve to help you save or make more money.