How to save taxes? Let’s count the ways.

Seniors will love the new tax bill!

If you are 65 years of age or older, several provisions in the One Big Beautiful Bill Act (“Big Beautiful Bill”) would be especially relevant: In summary, the most significant changes for someone age 65 or older are the new temporary $6,000 senior deduction, increased standard deduction amounts, and higher filing thresholds

Out with the old – in with the new 2023 mileage rates

It’s easy to forget about the business use of your personal car. Here’s how to calculate this deduction for all your business miles.

Are there exceptions to the 10% early withdraw Penalty?

Actually there are quite a few. Here’s a partial list.

Why you should start a 529 Plan for your 2 year-old child

Start the 15-year clock! Open a 529 plan for each child today. It doesn’t take thousands of dollars or in some cases even hundreds of dollars-maybe as little as $100 to open this savings account. By opening it now the parent can start the 15-year savings clock so that all earnings in the account are…

More Security from the Secure Act 2.0

At What Age Does the Government Require the RMD? The chart below gives you the age when you have to start taking RMDs: Your Birth Year Your Mandatory RMD Age 1950 or earlier 72 (70.5 for those who turned 70.5 before 2020) 1951-1959 73 1960 or later 75 When Do I Have to Take My…

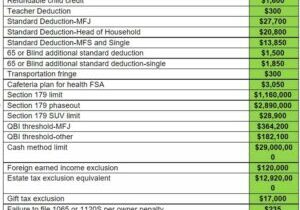

Inflation adjustments to tax items

With inflation at a 40-year high, inflation-adjusted tax amounts have kicked into place. Here are the increased amounts for 2022 and 2023.

IRS grants penalty relief!

This is a rare gift from the imperial IRS. Check the article below for details.

MMDA- Making meals deductible again

Have you missed partying and having business meals with your prospects, customers, and employees? Well, get ready to start again. Soon, COVID-19 will be behind us, we can get back to normal. To help you get ready, check the table below for what you can do in 2021 and 2022 as the law stands now:…

How to save taxes? Let’s count the ways.

Small Business Alert!

Don’t fall for newest IRS scam

Identity Theft – Part III

In parts one and two of our ID Theft series, the focus was on an outsider taking your money. Today…

Advanced ID Theft – How they do it

When it comes to protecting ourselves from ID theft, our problem is that most of us don’t think the same…

RMDs made PDQ

This subject reminds of a famous line from the movie Jurassic Park. “Your scientists were so preoccupied with whether or…

The worst kind of ID theft

Although we’re very good at tax and accounting, when it comes to legal matters, it always pays to consult a…

Your stimulus check- how to make sure IRS gets it right

Most of us are a little doubtful of the IRS’ ability to get things exactly right especially with the rebate…

EIDL vs PPP Loans from the SBA

Among all the talk of this and that SBA loans to help business activities, we thought we’d cut through the…

SBA Loans – What’s the difference?

It seems as though every business has an interest in obtaining some help from the SBA. While the process is…

SBA Disaster Loans- Are they right for your business?

Due to the Coronavirus problems, we’ve received a bunch of questions from business owners about SBA Loans. The slide show…

Helpful Tools for Clients

For our first-time guests and new clients:

The first thing that you should look for in your Financial Advocate is the right attitude.

At SCA we don't believe in the "one size fits all" method of thinking. We post recent articles that may serve to help you save or make more money.